Home

About Us

Page 2

The program will enable you to pay at least $1,000 of your own money and then shoulder a maximum amount of up to $8,000 which is not payable until 30 years after you purchased your house. In addition, this Downpayment Assistance Program can also be used in conjunction with the FirstHome Mortgage Program that is also offered by the North Carolina HFA.

|

|

If you wish to considered eligible to apply for the Downpayment Assistance Program, you should be able to satisfy the following eligibility requirements which states that you should be:

1) A first time home buyer or a veteran who is planning to acquire a home in a targeted area

2) A person who has not owned a home or occupied it as his/her primary residence for the last three years

3) A person whose annual income does not exceed the limits that are set by the North Carolina Housing Finance Agency

4) A person who wishes to acquire a property whose selling point does not exceed the limits that are set by the North Carolina Housing Finance Agency

5) A citizen and a legal resident of the United States of America

6) A person who is planning to occupy the purchased home within 60 days before closing.

The Downpayment Assistance Program is naturally not due until after 30 years of procurement, but payment will have to made earlier if the borrower opts to sell, transfer, or refinance his North Carolina HFA-financed property.

Downpayment Assistance Program for the First Time Home Buyers in North Carolina

Back to Page 1

About The Author The TopGovernmentGrants Editorial Staff maintains one the most comprehensive Websites offering information on government grants and federal government programs. The staff also provides resources to other Websites with information on environmental grants and grants for youth programs. |

Additional Resources

category - Home Buying Programs

Government Grants within the United States Housing Sector

First Time Homebuyer Programs in Connecticut

Keystone Home Loan PLUS Program

Connecticut Housing Finance Agency Mortgage Programs for Military, Police and Teachers

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

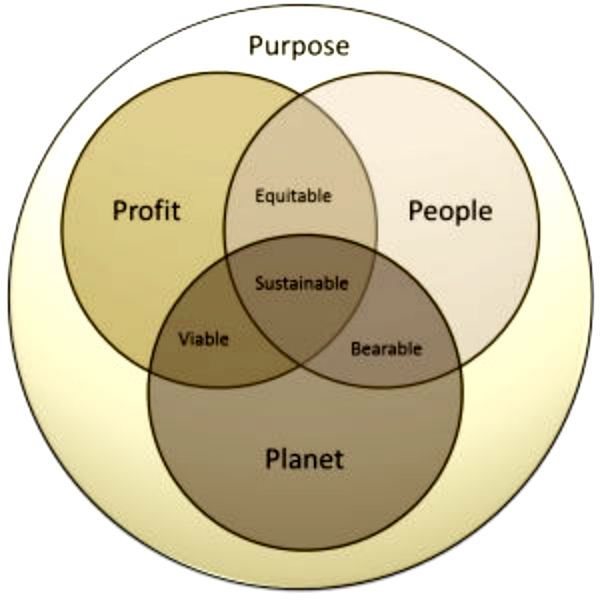

Social Enterprise Associates Guide Clients to Spur Social Wellbeing and Purpose

Social Enterprise Associates (SEA), a New Mexico fellowship of consultants banded together to deliver social mission-based services, are the first, B Lab certified company in the region and have been awarded as one of the 2014 Best for the World B Corps for their long-range economic and social impact.