Home

About Us

Page 2

a) A first time home-buyer (someone who has not owned a home)

|

|

b) A legal citizen of the United State, a permanent resident or a qualified alien.

c) Satisfy the credit, loan, and income requirements that are set by CalHFA and the mortgage insurer

d) Able and willing to live in the AHPP-financed home until the end of the loan or until the house is refinanced or sold.

e) Willing to participate in a home buyer counseling program and must a have a certificate to verify it.

f) If the borrower is not a first time home buyer, he should be a veteran or a someone who is trying to acquire a home at a federally designated targeted area.

In terms of the property eligibility requirements, the borrower must choose a home that is:

1) Located in the State of California

2) Capable of becoming the borrower's primary residence

3) Priced within the limits set by CalHFA

4) Not larger than 5 acres

5) Categorized as a single family residence

6) A condominium or a unit in a planned unit development

In addition, borrowers under the CHDAP is also required to shell out a minimum contribution that is equal to 1% (or $1,000) of the total value of the property.

First Time Homebuyer Programs in California

Back to Page 1

About The Author Michael Saunders is an editor of TopGovernmentGrants.com one the the most comprehensive Websites offering information on government grants and federal government programs. He also maintains Websites providing resources on artist grants and children grants. |

Additional Resources

category - Home Buying Programs

Keystone Home Loan PLUS Program

FirstHome Mortgage Program in North Carolina

Department of Housing and Urban Development's Dollar Homes Program

Homebuyer Mortgage Program for First Time Homebuyers in Connecticut

Follow @topgovtgrant

Social Entrepreneurship

Spotlight

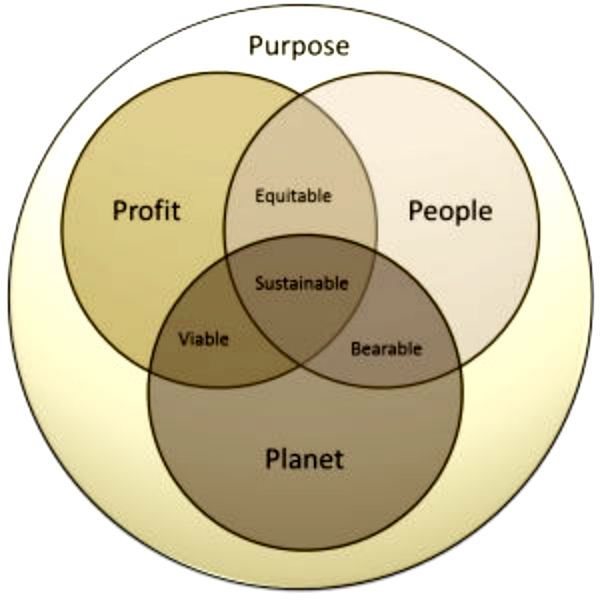

Social Enterprise Associates Guide Clients to Spur Social Wellbeing and Purpose

Social Enterprise Associates (SEA), a New Mexico fellowship of consultants banded together to deliver social mission-based services, are the first, B Lab certified company in the region and have been awarded as one of the 2014 Best for the World B Corps for their long-range economic and social impact.